UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x☒

Filed by a Party other than the Registrant

Check the appropriate box:

| ☐ | |

| Preliminary Proxy Statement |

| Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material under §240.14a-12 |

WEC Energy Group, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | |

| No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: |

NOTICE OF 2023 ANNUAL MEETING

AND PROXY STATEMENT

| P-1 |

This Page Intentionally Left Blank

| WEC Energy Group | P-2 |

Dear Fellow Stockholders

On behalf of our Board of Directors, I cordially invite you to attend WEC Energy Group’s Annual Meeting of Stockholders. We look forward to hosting this year’s meeting atin virtual format.

Throughout the New York Stock Exchange, following their invitation to recognize the company’s long-standing listingyear 2022, our Board of Directors and management team maintained a clear focus on the Exchange.

Below are several highlights that demonstrate our investors. These constructive dialogues informed our Board’s decision making throughout the year.

Financial Performance

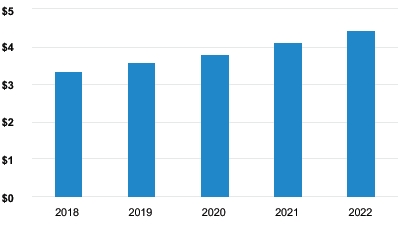

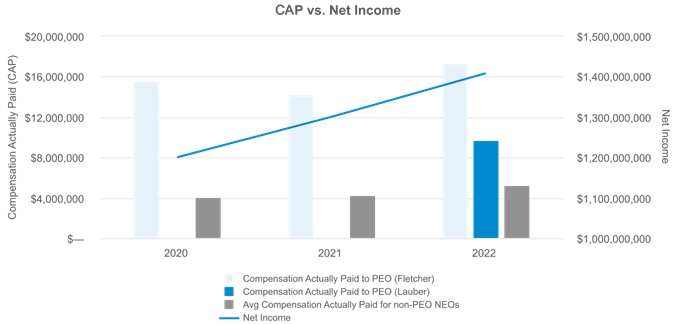

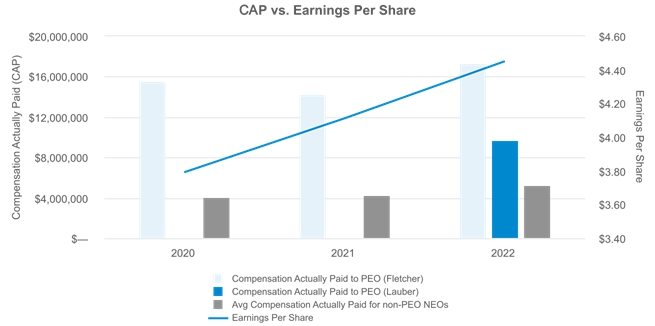

| • | Achieved record net income and record earnings per share. | |

| • | Returned more cash to stockholders than in any other year in company history. | |

| • | Declared a 7.2 percent increase in our dividend in January of 2023 — the twentieth consecutive year of dividend increases for our stockholders. | |

| • | Developed the largest five-year capital investment plan in the Company’s history. |

Environmental Stewardship

| • | Made significant progress on our energy transition, including regulatory approval of our first two renewable projects utilizing solar panels and batteries. | |

| • | Partnered with the Electric Power Research Institute to lead a pilot program — one of the first of its kind in the world — to test hydrogen as a fuel source for power generation. | |

| • | Received approval for a renewable natural gas pilot program, with contracts in place to connect our natural gas distribution network to local dairy farms. | |

| • | Published the third edition of our climate report, which details our clean energy strategy while continuing to serve our customers affordably and reliably. |

Social Initiatives

| • | Achieved the best employee safety record since our Company doubled its size through a major acquisition in 2015. | |

| • | Contributed through our charitable organizations more than $20 million to worthy organizations across our service areas. Our major focus areas continue to be: education, community and neighborhood development, arts and culture, and the environment. | |

| • | Published the Company’s first Supplier Diversity Economic Impact Report, demonstrating the catalytic impact of our supplier diversity programs. |

Responsible Governance

| • | Achieved a seamless transition to a new CEO, and completed 2022 with the most diverse senior leadership team in Company history. | |

| • | Appointed five new independent directors since 2019 — adding broad experience and overall diversity to an engaged and effective board. | |

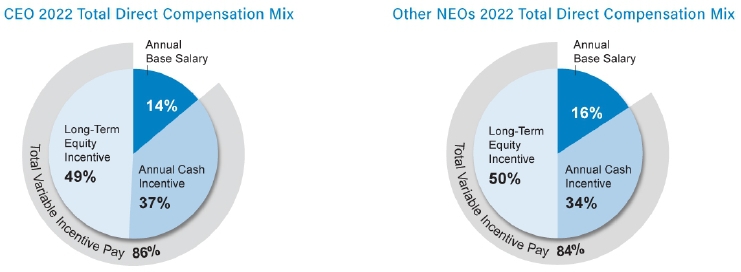

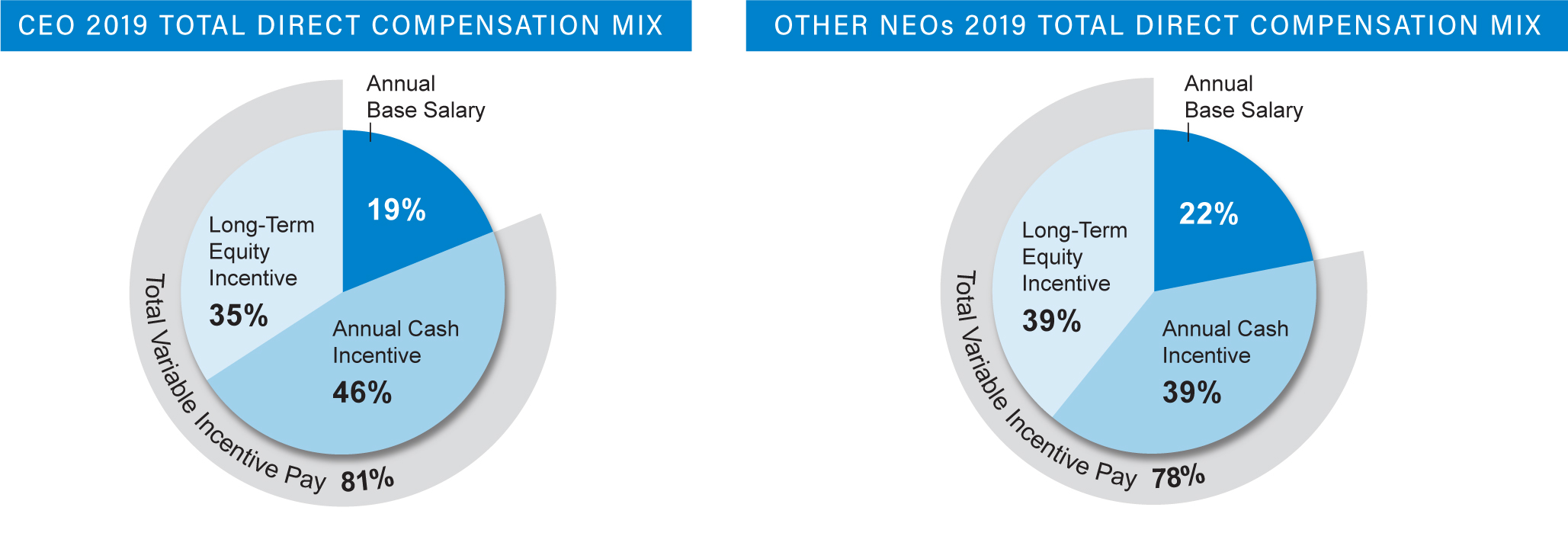

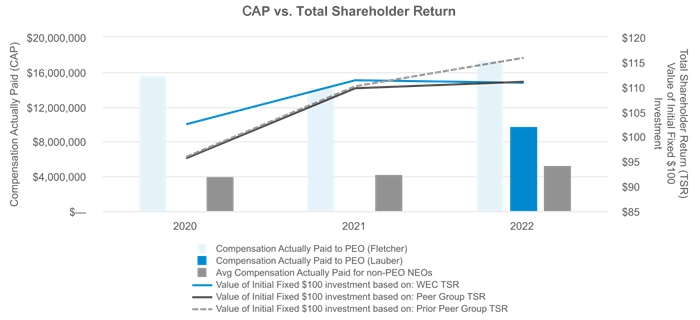

| • | Extended our track record of strong linkage between pay and performance, with challenging financial and ESG metrics in our incentive compensation program. Received 94.2 percent support from shareholders for our executive compensation program at the 2022 annual meeting. |

We ask for your support of the threefour proposals requiring a vote at this year’s Annual Meeting.meeting. And, as always, we welcome your continued engagement. Thank you for your confidence in WEC Energy Group.

Gale E. Klappa

Executive Chairman

| WEC Energy Group | P-3 | 2023 Proxy Statement |

Notice of 2023 Annual Meeting of Stockholders

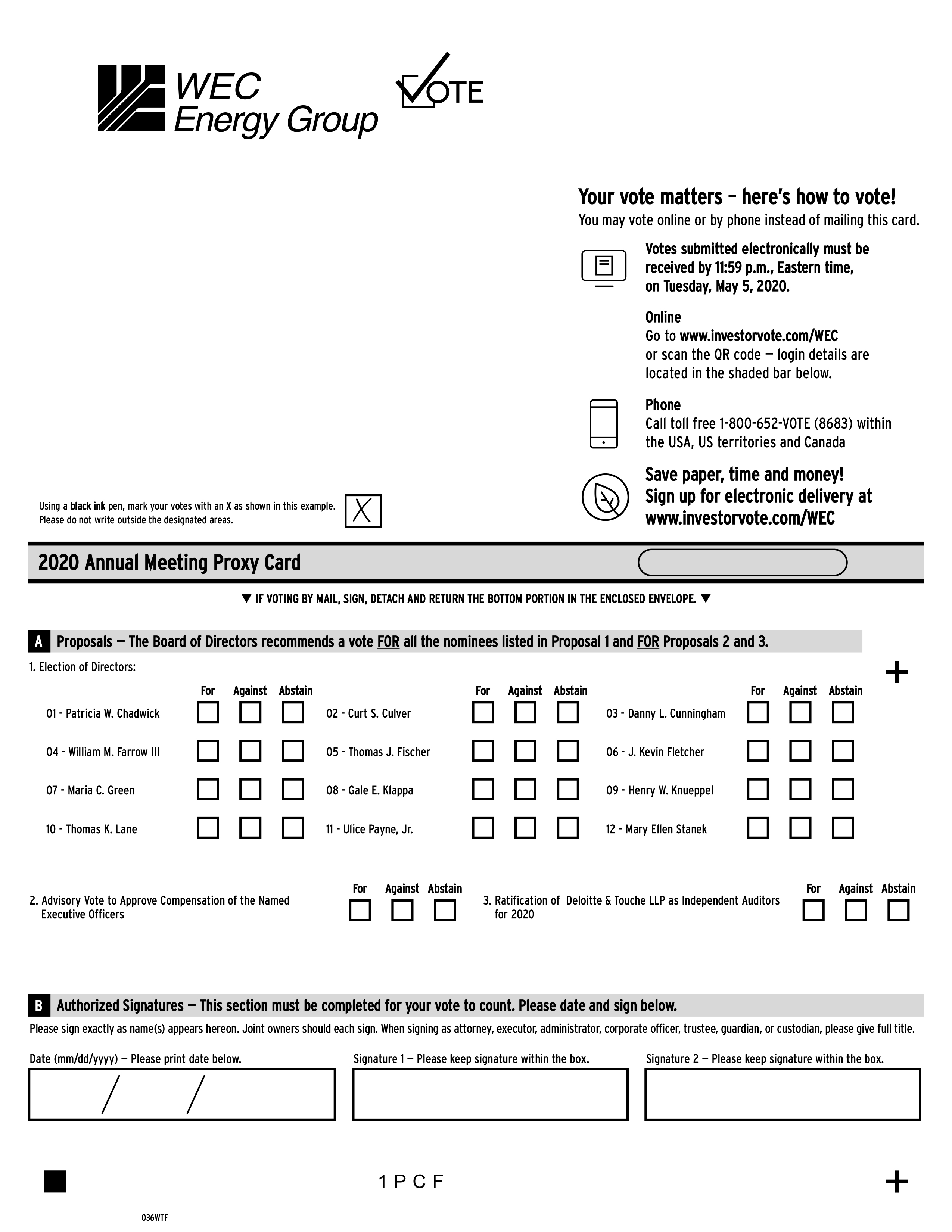

Date and Time Thursday, May 4, 2023 at 1:30 p.m., Central time Location WEC Energy Group will hold a virtual annual stockholders meeting, held exclusively online at www.meetnow.global/MPNLAWV. Access to the meeting begins at 1:15 p.m., Central time. Items to be voted 1. Election of 12 directors for terms expiring in 2024. 2. Ratification of Deloitte & Touche LLP as independent auditors for 2023. 3. Advisory vote to establish the frequency of “say-on-pay” vote. 4. Advisory vote to approve compensation of the named executive officers. In addition, we will consider and act upon any other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. How to attend the 2023 Annual Meeting This year’s Annual Meeting will take place entirely online. If you would like to participate in the meeting, including voting, submitting a question, or examining our list of stockholders, you will need to visit our meeting site, located at www.meetnow.global/MPNLAWV, and enter your control number. Consistent with our prior virtual meetings, we will offer stockholder rights and participation opportunities during the meeting that are similar to our past in-person annual meetings. Registered Stockholders. If your shares are registered in your name, your 15-digit control number was included on your Notice of Internet Availability of Proxy Materials, your proxy card or on the instructions that accompanied your proxy materials. Beneficial Owners. If you own shares in “street name” (that is, through a broker, bank or other nominee), you must register in advance to obtain a control number. For more information, see Annual Meeting Attendance and Voting Information, which begins on P-74. Your vote is very important to us. We urge you to review the proxy statement carefully and exercise your right to vote. Even if you plan to attend the Annual Meeting, please vote your shares as soon as possible using one of the voting methods outlined in this notice. If you vote in advance, you are still entitled to vote at the Annual Meeting, which would have the effect of revoking any prior votes. | Voting methods | ||

Use the Internet Vote shares online.  Mobile Device Scan this QR code.  Call Toll-Free In the U.S. or Canada call  Mail your Proxy Card Follow the instructions on your voting form. | |||

Record Date Stockholders of record as of close of business on February 23, 2023 (Record Date), will be entitled to vote. Each share of common stock is entitled to one vote for each director position and one vote for each of the other proposals. On or about March 23, 2023, the Proxy Statement and 2022 Annual Report are being mailed or made available online to stockholders. Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on May 4, 2023: The Proxy Statement and 2022 Annual Report are available at www.envisionreports.com/WEC. | |||

Margaret C. Kelsey

Executive Vice President, General Counsel and Corporate Secretary

March 23, 2023

| WEC Energy Group |

Table of Contents

| Forward-Looking Statements | P-6 |

| P-6 | |

| P-12 | |

| 2024 | |

| P-13 | |

| Succession Planning/Director Nomination |

| P-16 | |

| P-18 | |

| P-24 | |

| P-24 | |

| P-27 | |

| P-29 | |

| P-30 | |

| Board and Committee Practices |

| P-30 | |

| P-31 | |

| P-32 | |

| Compensation Committee Interlocks and Insider Participation |

| P-34 | |

| P-34 | |

| Communications with the Board |

| P-35 | |

| P-35 | |

| P-36 | |

| P-38 | |

| 2023 | |

| Independent |

| P-39 | |

| Audit and Oversight Committee Report |

| P-73 | |

| Annual Meeting Attendance and Voting Information |

| WEC Energy Group | P-5 | |

Forward-Looking Statements

The statements contained in this proxy statement about our future performance, including, without limitation, future financial and operational results, strategic initiatives, execution of our capital plan, emissions reduction goals and all other statements that are not purely historical, are “forward-looking statements” within the meaning of Section 27A of the methods shown below. Make sure you have a proxy card, voting instruction form or noticeSecurities Act of 1933 and Section 21E of the Internet availabilitySecurities Exchange Act of 1934. There are a number of risks and uncertainties that could cause actual results to differ materially from any forward-looking statements made herein. A discussion of some of these risks and uncertainties is contained in handour Annual Report on Form 10-K for the year ended December 31, 2022, and followsubsequent filings with the instructions.Securities and Exchange Commission (“SEC”). These reports address in further detail our business, industry issues and other factors that could cause actual results to differ materially from those indicated in this proxy statement. Except as may be required by law, we disclaim any obligation to publicly update or revise any forward-looking statements.

| |

Other reports and website references. In this proxy statement we identify certain reports, including our climate report, and materials that are available on or through our website. These reports and the information contained on, or available through WEC Energy Group common stock atGroup’s website, are not “soliciting material,” are not deemed filed with the close of business on Feb. 26, 2020. Each share of common stock is entitledSEC, and are not, nor shall they be deemed to one vote for each director position and one vote for each of the other proposals.

Proxy Summary

This summary highlights selected information related to items to be voted on at the annual meeting of stockholders. This summary does not contain all of the information that you should consider when deciding how to vote. Please read the entire proxy statement before voting.

Additional information regarding WEC Energy Group, Inc.The 2023 Annual Meeting of Stockholders will be a virtual-only meeting via live webcast. There will not be a physical meeting location. Stockholders are encouraged to participate online by logging into www.meetnow.global/MPNLAWV where you will be able to listen to the meeting live, submit questions and vote your shares. Please see page P-74 for more information.

Voting Matters and Recommendations

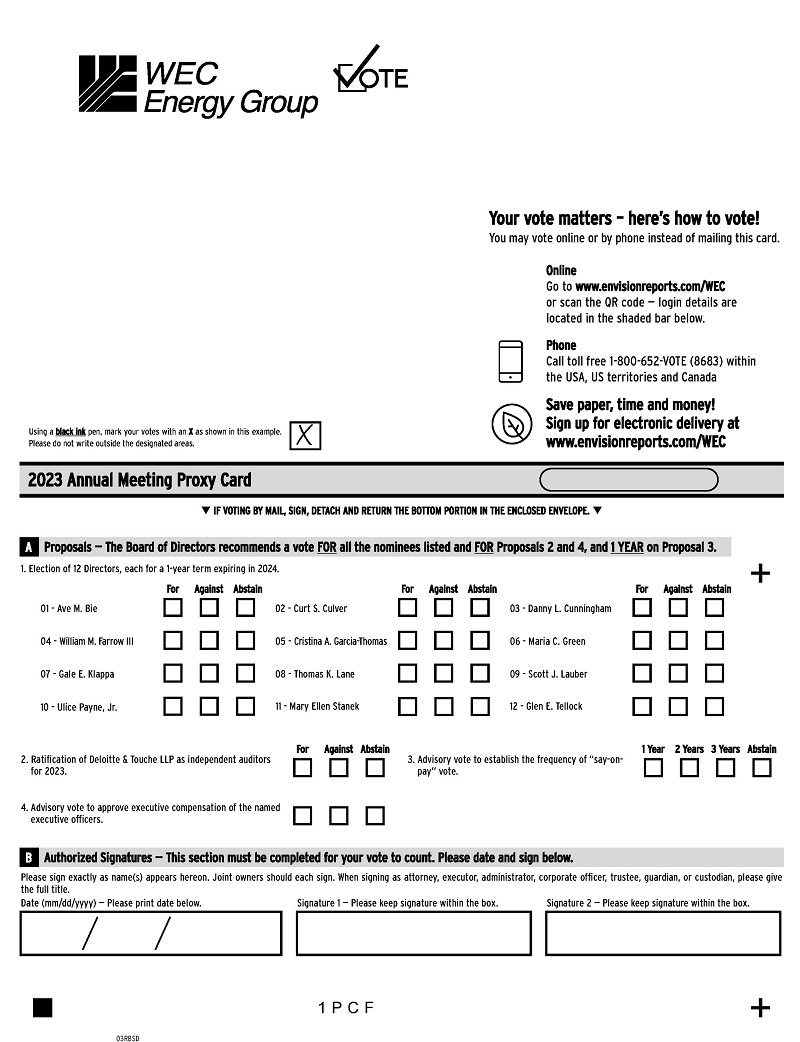

The following proposals are scheduled to be presented at our upcoming 2023 Annual Meeting of Stockholders:

| Item to be Voted on | Board’s recommendation | Page | |

| Proposal 1 | Election of 12 Directors, each for a one-year term expiring in 2024 | FOR each nominee | P-12 |

| Proposal 2 | Ratification of Deloitte & Touche LLP as independent auditors for 2023 | FOR | P-38 |

| Proposal 3 | Advisory vote to establish the frequency of “say-on-pay” vote | FOR every year | P-41 |

| Proposal 4 | Advisory vote to approve executive compensation of the named executive officers | FOR | P-42 |

| WEC Energy Group | P-6 | 2023 Proxy Statement |

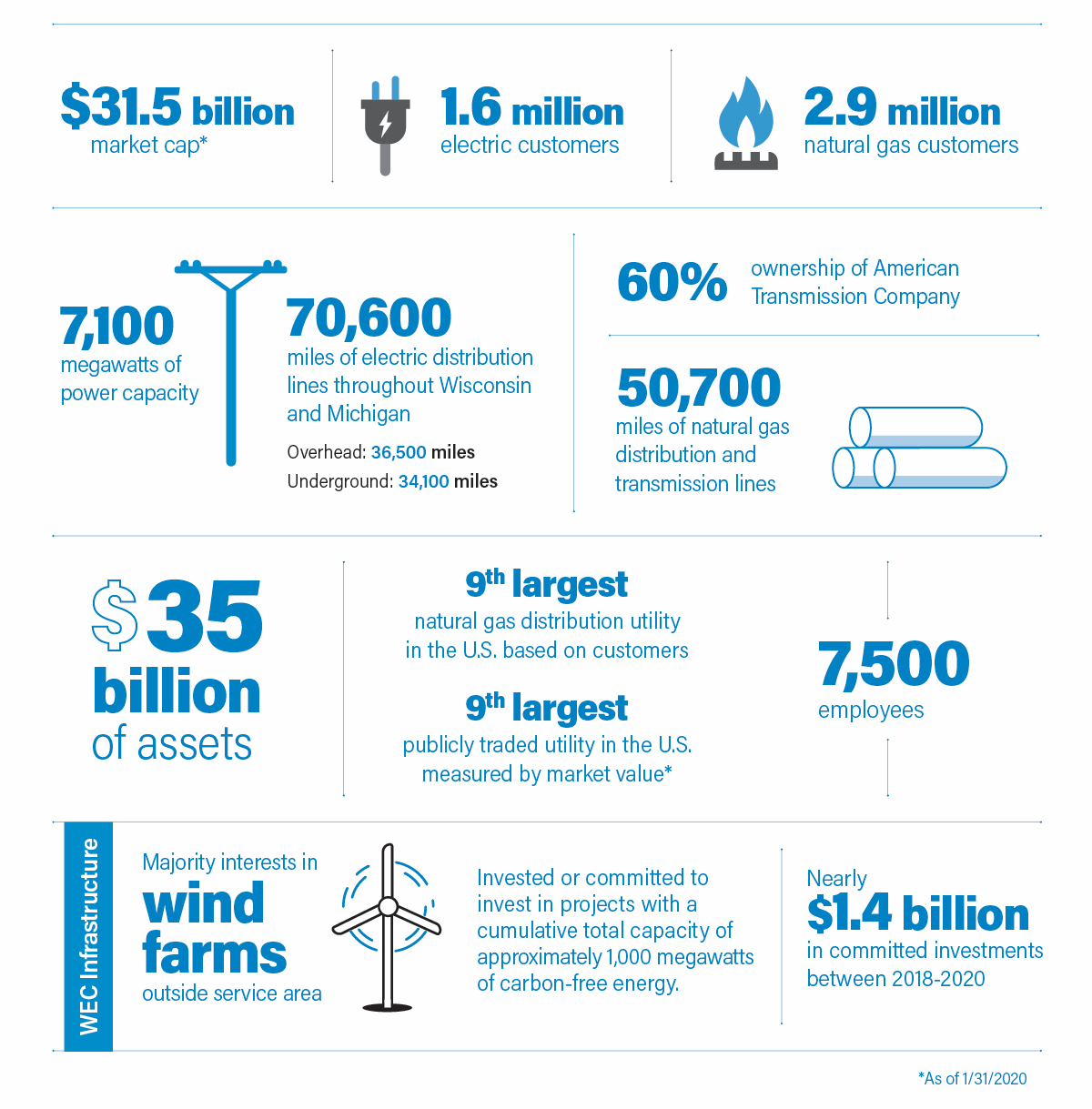

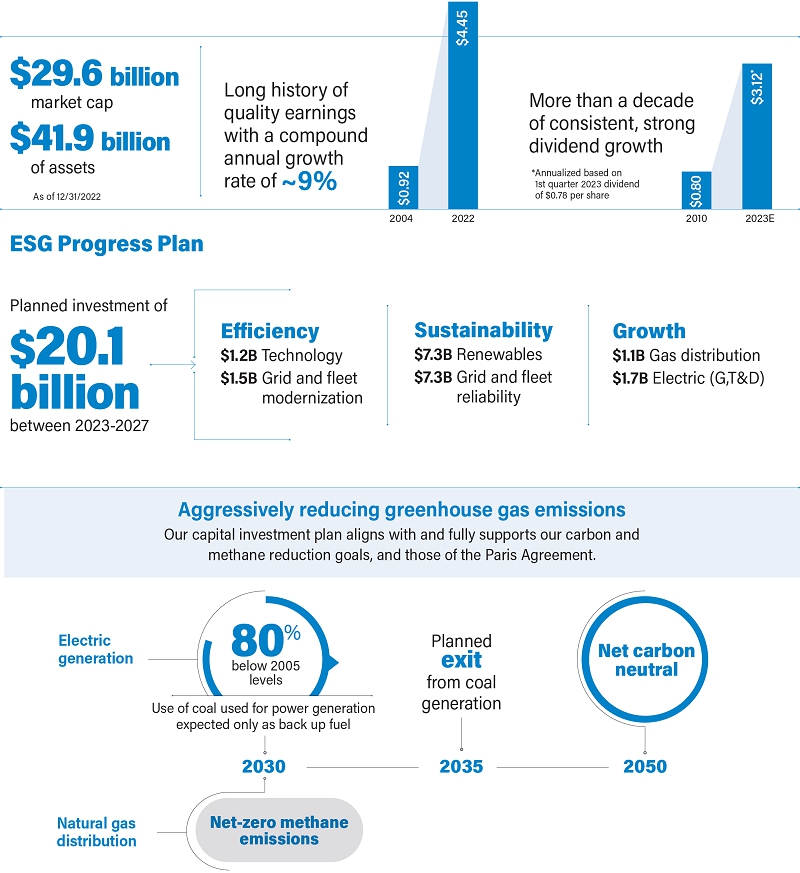

An Energy Industry Leader

WEC Energy Group is a leading Midwest electric and natural gas holding company with subsidiaries serving 4.6 million customers in Wisconsin, Illinois, Michigan and Minnesota. We also maintain majority ownership in American Transmission Company LLC, a for-profit electric transmission company regulated by FERC and certain state regulatory commissions. In addition, as part of our non-utility energy infrastructure segment, we own majority interests in a growing fleet of renewable generation facilities outside our regulated footprint. Our 7,000 employees are focused on providing affordable, reliable and clean energy for a sustainable future.

| WEC Energy Group | P-7 | 2023 Proxy Statement |

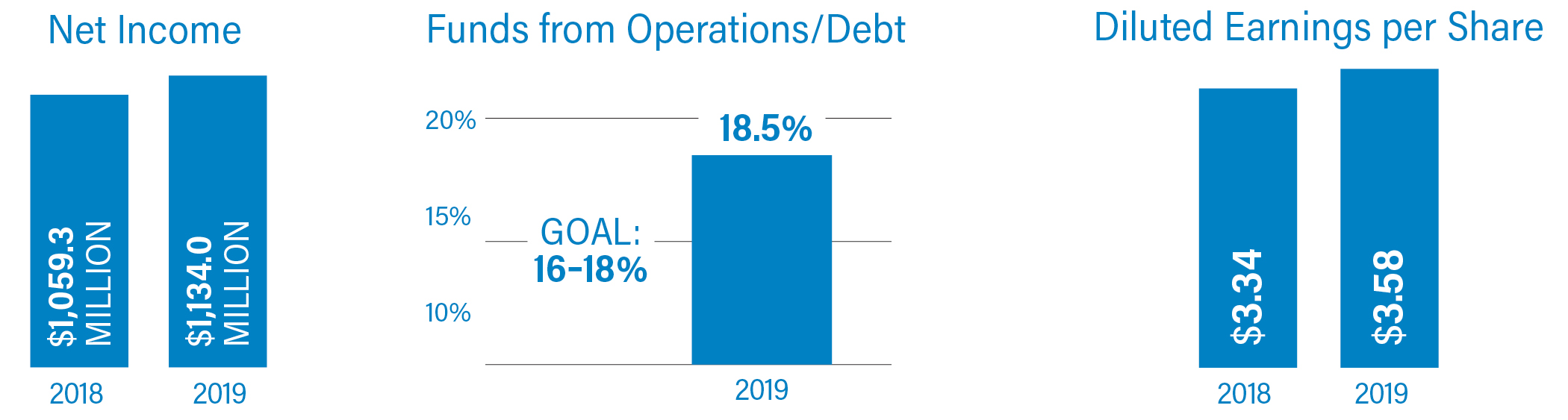

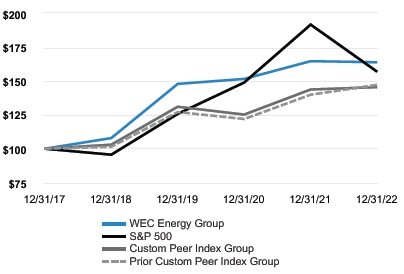

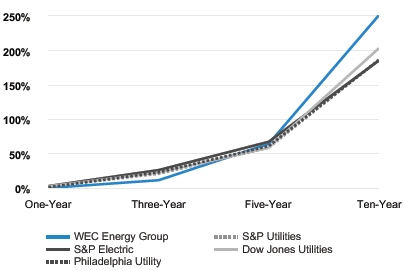

Our 2022 Performance Highlights

Throughout 2022, the Company remained steadfast in executing its fundamentals — safety, reliability, customer satisfaction, financial discipline and environmental stewardship — and ended the year having achieved solid financial and operational results, while delivering continued long-term value for stockholders and customers.

| Business Highlights / Awards and Recognition | Financial Highlights |

Made significant progress on the clean energy transition and our capital plan — the ESG Progress Plan. • The • We signed our first four contracts for renewable natural gas, which is expected to enter our natural gas distribution system in 2023. Local dairy farms will supply methane that would otherwise have gone to waste, replacing a portion of conventional fossil-based natural gas. • We continued work on projects to ensure reliable service, including the construction of liquefied natural gas storage facilities and highly efficient natural gas generation using reciprocating internal combustion engines. Led a pilot program — the first of its kind in the world — to test hydrogen as a fuel source for power generation, in partnership with the Electric Power Research Institute (“EPRI”). Strengthened the diversity of our leadership team — ended 2022 with the most diverse senior leadership team in company history. Spent $299 million with certified minority-, women-, veteran- or service-disabled-owned businesses. Included as a constituent of FTSE Russell’s FTSE4Good Index Series, which is made up of companies that reflect strong environmental, social and governance practices. Recognized by the Wisconsin Department of Workforce Development with the Vets Ready Employer Initiative Award for supporting veterans in the workforce and the community. Employees received multiple Technology Transfer Awards from EPRI for achievements in research and development. Peoples Gas was presented with the Midwest Energy Efficiency Alliance’s Inspiring Efficiency Award in recognition of an innovative partnership with Chicago Public Schools. Finished in first place overall in the E Source Large Business Customer Satisfaction Study. Received recognition in Escalent’s 2022 Cogent Syndicated Utility Trusted Brand & Customer Engagement studies: • Wisconsin Public Service Corporation (“WPS”) • Peoples Gas and WPS were named ‘Environmental Champions’ in the residential study. • In the business study, We Energies was recognized as a ‘Business Customer Champion’. | $1.4 billion record net income $4.45 record earnings per share, on a diluted basis 7% dividend growth $918 million cash returned to stockholders 19 consecutive years 80 consecutive years |

| P-8 | 2023 Proxy Statement |

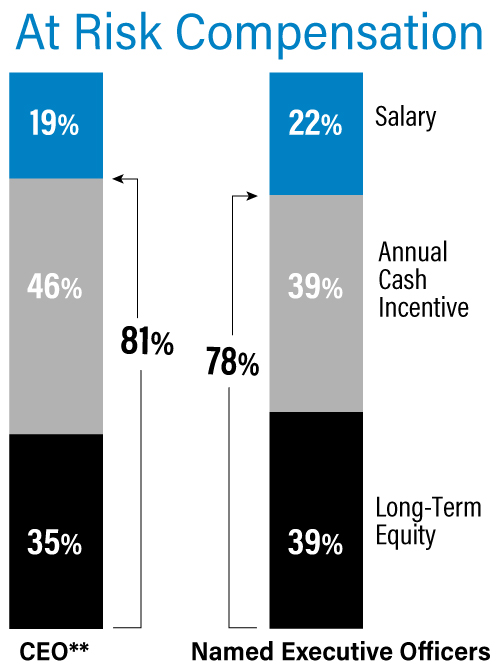

How our Compensation Program Supports our Business Strategy

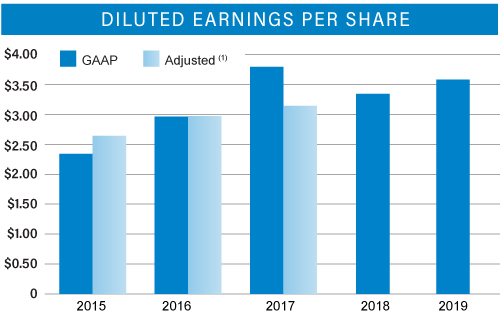

An important aspect of the Board’s oversight responsibilities is to hold the executive management team accountable to achieving the Company’s goals and objectives, and reward them appropriately when they do. This includes oversight of executive compensation.

Since 2004, our executive compensation program has included metrics that link a substantial portion of executive pay to achieving financial, operational and social targets tied to our business fundamentals. These targets are linked to key objectives that underpin the company’s sustainability.

Social Matters

Incentive targets associated with operational and social goals are tied to strategic priorities, which include, among other things, a focus on employee safety, customer satisfaction, and workforce and supplier diversity.

Environmental Matters

Delivering a cleaner energy future to our customers while maintaining affordability and reliability, is one of our core responsibilities and a major focus of our capital plan. Rather than attempting to create unique metrics associated with long-term climate goals, the Compensation Committee assesses management’s performance against environmental goals through the execution of its capital plan. Management annually refreshes the capital plan, discusses it with the Board, including a preview of anticipated capital spending over five years, and then publicly discloses its plan during the fourth quarter each year.

The Company’s ability to fund its substantial capital plan without issuing additional equity has been directly linked with the Company’s ability to consistently deliver on its financial plan, including meeting the targets associated with the financial metrics used in the Company’s compensation program. These financial metrics are key performance indicators underlying our executives’ incentive compensation.

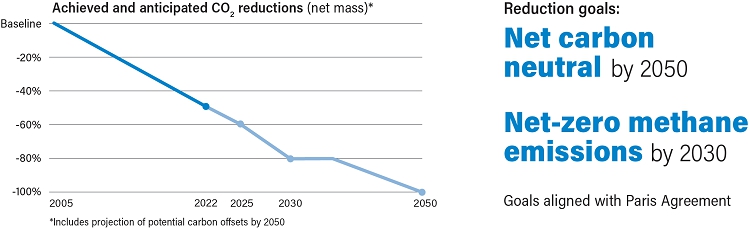

Our Efficiency, Sustainability and Growth Progress Plan

In November 2022, the Company announced its 2023-2027 capital plan, referred to as our ESG Progress Plan, which details planned significant investments in low- and no-carbon generation and modernization of the Company’s electric and natural gas infrastructure aimed at helping to reduce the emission of greenhouse gases (carbon and methane). These investments are the building blocks for the Company’s carbon dioxide emission reduction goals from our electric generation — 60% below 2005 levels by the end of 2025, 80% below 2005 levels by the end of 2030, and net carbon neutral by 2050. The plan also supports the Company’s goal to achieve net-zero methane emissions from natural gas distribution lines in its network by the end of 2030.

| WEC Energy Group |

| Governance Highlights | |||

Accountability to our stockholders is critical to our long-term success. We routinely evaluate and enhance our governance practices to maintain alignment with evolving best practices. Highlights of our governance framework and matters with which the Board was involved during 2022 are noted below.

Governance Framework Board Independence/Composition • 10 of 12 director nominees are independent • Independent Lead Director with defined duties, elected by other independent directors • Independent Audit, Compensation, Finance and Governance Committees • Opportunity for executive sessions at every board and committee meeting • 50% of Board nominees are diverse by gender or race/ethnicity Board Oversight • Short- and • Leadership succession planning • Code of • Corporate sustainability, including risks and • Regular reporting from Board committees on specific risk oversight responsibilities Board and | • Separate Chairman and CEO Ongoing Board refreshment• • • • • • • Director service on public boards limited to 4 companies • Stockholder Rights • • Majority voting standard for uncontested elections • • bylaws Annual “say-on-pay” advisory vote• | ||

| Oversight of 2022 Strategic Initiatives The Board is actively engaged in the oversight of the Company’s strategy, providing advice and counsel as warranted and holding management accountable for making sound decisions on many important initiatives affecting its stakeholders. Examples during 2022 included: • ESG Progress Plan, updated in November 2022, to reflect the Company’s anticipated capital expenditures over five years, allocated across strategies aimed at delivering efficiency, sustainability and growth, while providing transparency to investors • Leadership succession plans, including the transition to a new CEO, the leadership transition for the Company’s Illinois regulated utility subsidiaries, and development of emerging leaders across the enterprise • Greenhouse gas emissions goals and status, including evaluation of Scope 3 emissions • Capital projects, investments and research tied to the execution of the Company’s ESG Progress Plan, including the pilot program to test hydrogen as a fuel source for power generation, and the impact of supply chain disruptions on renewable energy project timelines and costs • Company’s enterprise security roadmap and cyber-incident response plan • Recessionary impact on the utility industry and trends reshaping the sector • Enterprise risk updates, including annual report and quarterly focus areas • Federal and state regulatory and government policy matters, including the impact of and opportunities created by the Inflation Reduction Act 2022 Governance Highlights The Board is committed to ensuring the Company conducts its business with the highest standards of ethics, integrity and transparency. Governance highlights from 2022, which occurred under the Board’s oversight, include: • Added 5 new independent directors since 2019 • Adopted revisions to committee charters to reflect best practices and expanding risk oversight responsibilities • Established independent board director fees consistent with market, as recommended by outside advisor • Modified two competencies in our board skills matrix to better align with oversight of our areas of focus • Received guidance on new and proposed SEC rules, including those related to climate disclosure, universal proxy, pay versus performance, and clawback of executive compensation • Launched new format for annual core policy training for the Board of Directors • Focused on expanding and enhancing public disclosures of interest to stakeholders: ◦ Issued the Company’s third Climate Report, following the recommendations of the Task Force on Climate-Related Financial Disclosures (“TCFD”) framework ◦ Issued corporate responsibility report in alignment with the Sustainability Accounting Standards Board (“SASB”) industry standards ◦ Published the Company’s consolidated EEO-1 Report ◦ Published an independent assurance statement about the Company’s emissions data prepared by a third-party consulting firm ◦ Issued Supplier Diversity Initiative economic impact report ◦ Enhanced the public disclosure of the Company’s political activities, corporate political donations and lobbying | ||

| WEC Energy Group | P-10 | 2023 Proxy Statement |

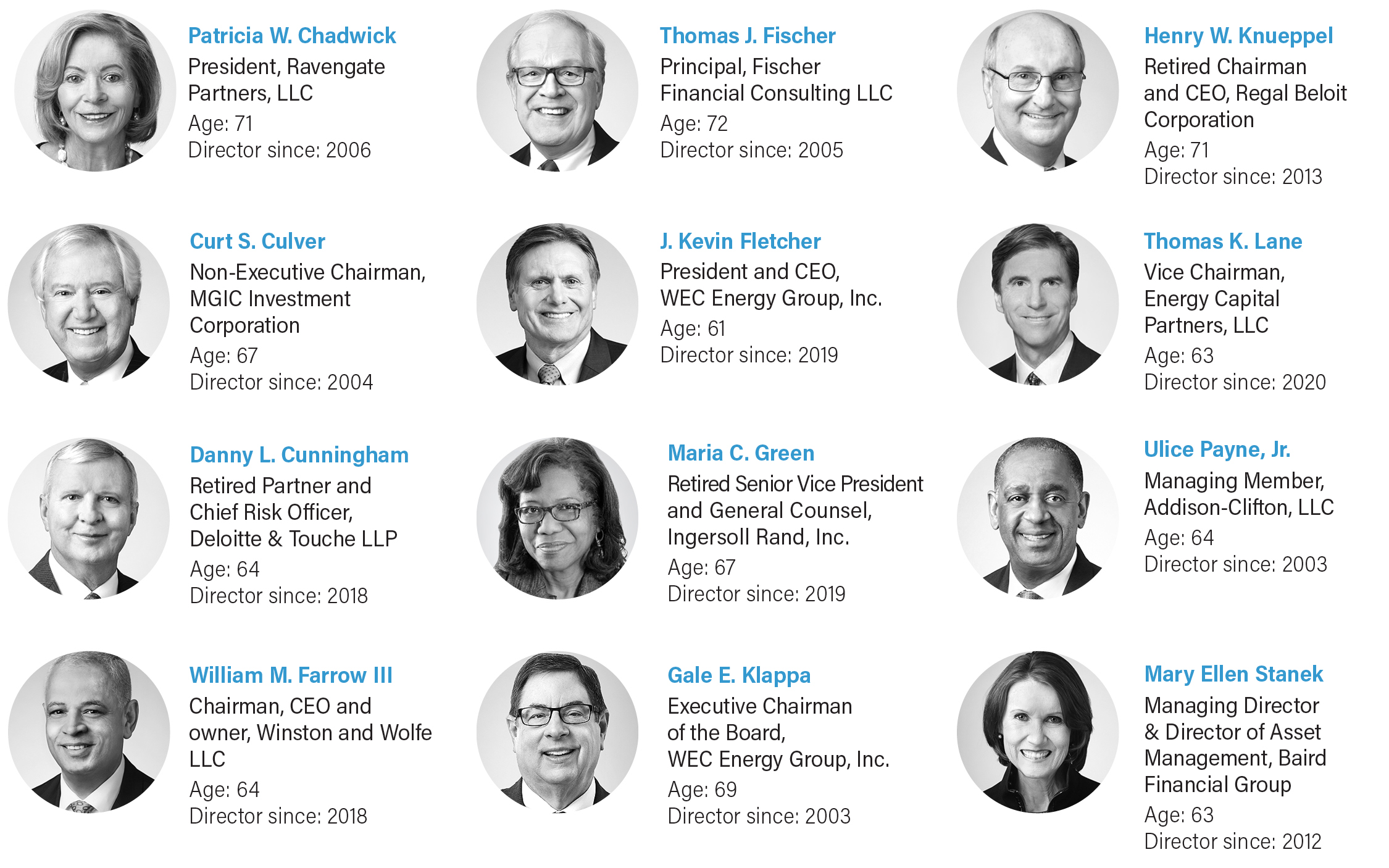

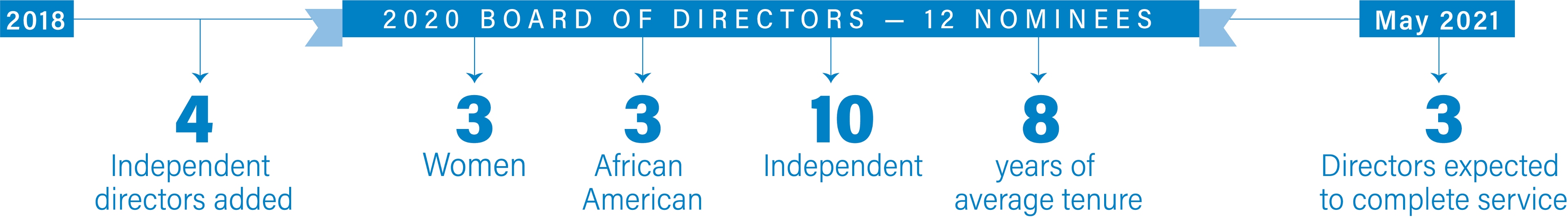

The Director Nominees at a Glance

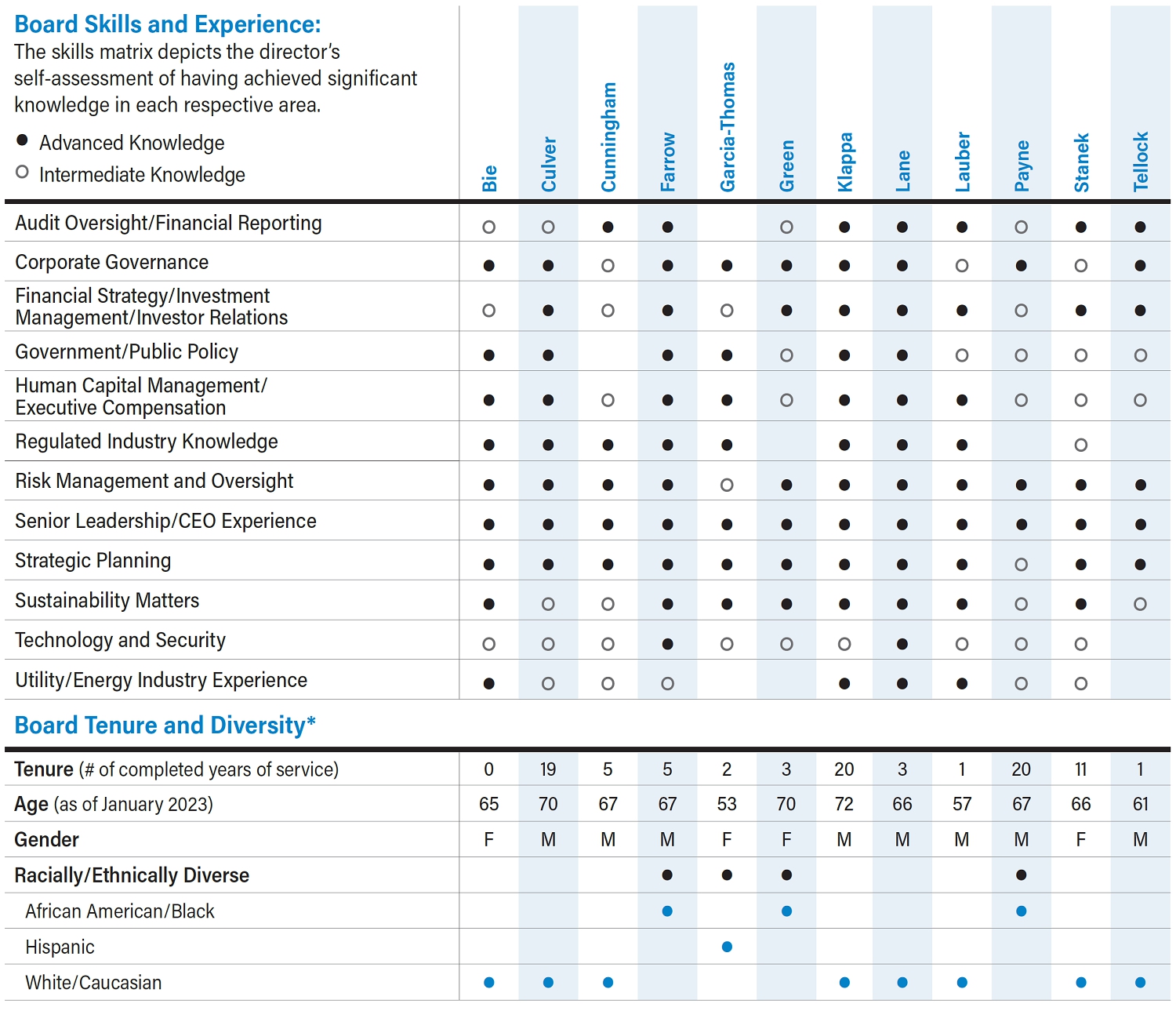

The following table provides an overview of the director nominees. Other than Ave M. Bie, who was elected by the Board and began service on January 1, 2023, all of the director nominees were elected at the 2022 Annual Meeting of Stockholders. Additional information regarding our director nominees, including a detailed skills matrix, begins on P-14.

See P-14 for diversity characteristics self-identified by each director.

| WEC Energy Group |

| PROPOSAL 1: ELECTION OF DIRECTORS – TERMS EXPIRING IN 2024 | |||||

| ||||||

What am I voting on? Stockholders are |

Voting Recommendation: ✓ FOR the election of | |||

each Director Nominee. The Board | |||

WEC Energy Group’s bylaws require each director to be elected annually

to hold office for a one-year term.| 1. Ave M. Bie | 5. Cristina A. Garcia-Thomas | 9. Scott J. Lauber |

| 2. Curt S. Culver | 6. Maria C. Green | 10. Ulice Payne, Jr. |

| 3. Danny L. Cunningham | 7. Gale E. Klappa | 11. Mary Ellen Stanek |

| 4. William M. Farrow III | 8. Thomas K. Lane | 12. Glen E. Tellock |

| • | All director nominees currently serve as directors on our Board. Other than Director Bie, who was appointed to our Board effective January 1, 2023, all nominees were elected by our stockholders at our 2022 Annual Meeting of Stockholders, each having received at least 92.91% of the votes cast. | |

| • | All director nominees are independent with the exception of Directors Klappa and Lauber, who are employees of the Company. Each nominee has consented to being nominated and to serve if elected. In the unlikely event that any nominee becomes unable to serve for any reason, the proxies will be voted for a substitute nominee selected by the Board upon the recommendation of the Corporate Governance Committee. | |

| • | This is an uncontested election; therefore, our majority vote standard for election of directors will apply. Under this standard, each director nominee will be elected only if the number of votes cast favoring such nominee’s election exceeds the number of votes cast opposing that nominee’s election, as long as a quorum is present. Therefore, presuming a quorum is present, shares not voted, whether by broker non-vote, abstention, or otherwise, have no effect on the election of directors. Proxies may not be voted for more than 12 persons in the election of directors. |

The Company sincerely thanks them for their many important contributions, leadership and years of dedicated service.

| WEC Energy Group | P-12 | 2023 Proxy Statement |

BOARD COMPOSITION

The Corporate Governance Committee and the Board evaluate director nominees in light of the Board’s current members, with the goal of recommending nominees with diverse backgrounds and experiences who, together with the current directors, can best perpetuate the success of WEC Energy Group’s business and represent stockholder interests. By adhering to a philosophy whereby directorDirector nominees are evaluated on the basis of certain minimum qualifications, Boardkey attributes, core competencies, diversity, age/tenure, existing time commitments and core competencies,independence. By following this process, the Board is able to attractensure that its director candidates that bring a broad range of perspectives and experiences, and who will effectively contribute to the Board, and will complement the Board.other directors.

The Corporate Governance Committee and the Board determined that the director nominees’ complementary breadth of characteristics are suited to executing the duties of the Board and, when taken together, embody the personal qualities, qualifications, skills, and diversity of background that best serve our Company and its stockholders.

| 2023 BOARD OF DIRECTORS — 12 NOMINEES | ||||

| Gender diversity | Racial/Ethnic diversity | Average age | Average tenure | Independence |

| 33% | 33% | 65 years | 7.5 years | 83% |

Key factors considered in recommendingAttributes Required of All Directors

The Corporate Governance Committee routinely evaluates the 2020 director nominees are listed below:

• Proven integrity • Ability to objectively • Relevant technological, • Familiarity with • Vision and imagination | • Mature and independent judgment • Ability to evaluate strategic options and risks • Social consciousness • Contribution to the | • Willingness to dedicate sufficient time to board service • Sound business experience/acumen • Achievement of prominence in career • Availability to serve for five years before reaching | ||

| | ||

Core Competencies

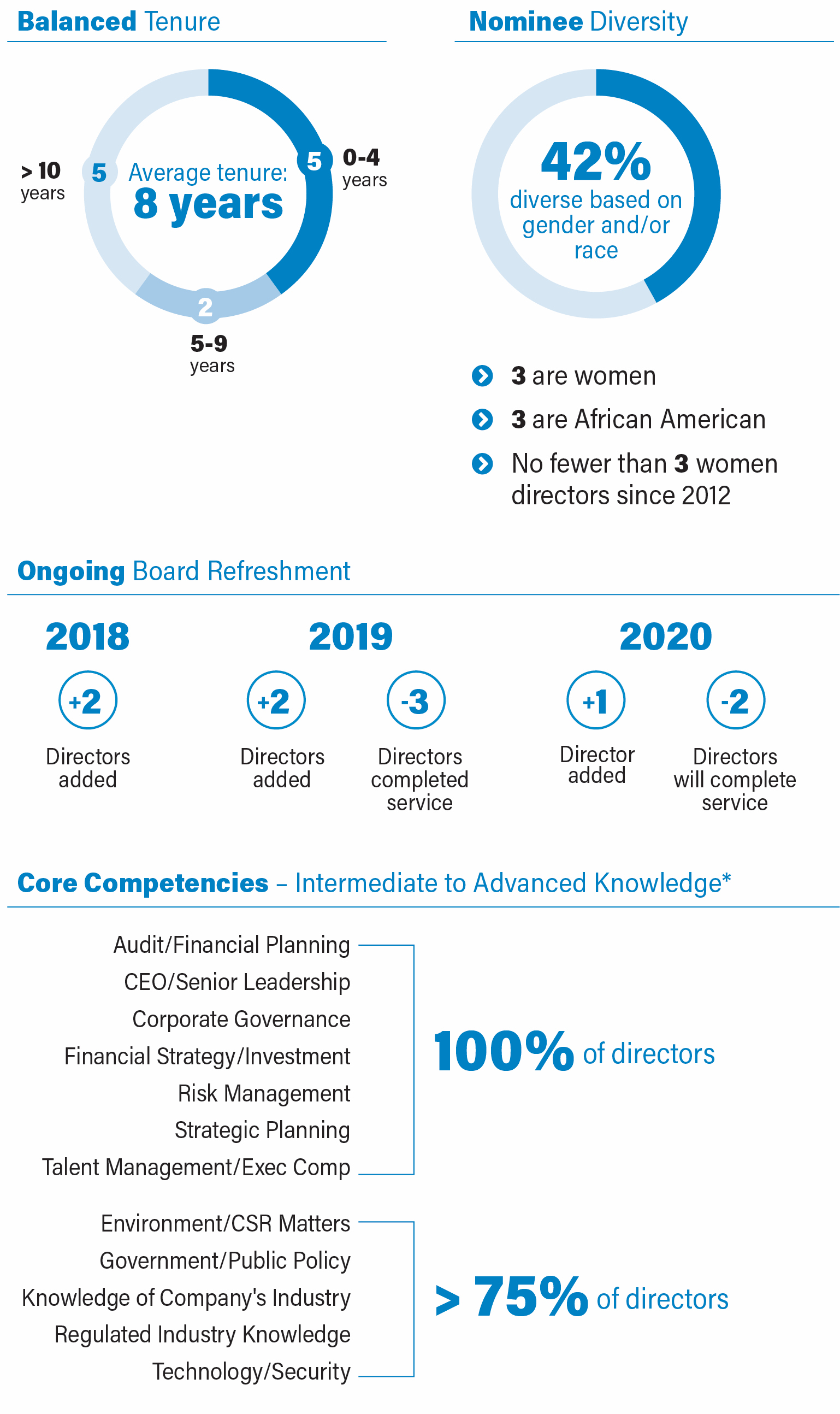

The Board regularly evaluates director nominees, it strives to cast a wide netqualifications and recommend candidates who each bring a unique perspective to the Board in order to contribute to a collective diversity - diversity of knowledge, skills, experiences, thought, gender, race/ethnicity, tenure and maturity.

With that in mind, the Corporate Governance Committee and Board have determined through the Board succession planning process that the Board’s composition should consist of candidates that collectively possess a specific set of core competencies, as listed below, in the Proxy Summary on page P-8,alphabetical order, in order to effectively carry out its oversight function.

• Audit/Financial Planning • CEO/Senior Leadership • Corporate Governance • Financial Strategy/Investment Management/Investor Relations | • Government/Public Policy • Human Capital Management/Exec Comp • Regulated Industry Knowledge • Risk Management and Oversight | • Strategic Planning • Sustainability Matters • Technology and Security • Utility/Energy Industry Experience |

During the fourth quarter of 2019,2022, the Corporate Governance Committee and Board evaluated and affirmed this set of competencies. Each director then performed a self-assessment of his/her level of knowledge in each skill area using the following 3-point scale: “1” Limited knowledge (e.g., no direct experience, primary exposure comes from Board or Committee reports); “2” Intermediate knowledge (e.g., general managerial/oversight experience or broad exposure as a Board or Committee member); “3” Advanced knowledge (e.g., direct experience; subject matter expert). A summary of the Board’s level of knowledge with respect to each of the core competencies was included inis shown on the Proxy Summaryfollowing page.

| WEC Energy Group | P-13 | 2023 Proxy Statement |

* Diversity characteristics based on page P-8.information self-identified by each director.

Diversity Diversity has been a major focus of the Corporate Governance Committee for decades when identifying director nominees. It is committed to actively seeking highly qualified individuals from underrepresented communities as it strives to cast a wide net and recommend candidates who bring unique perspectives to the Board, which contributes to its collective diversity - diversity of knowledge, skills, experiences, thought, gender, race/ethnicity, retirement age and tenure. We believe this diversity improves the overall effectiveness of the Board as it carries out its oversight role. |

Age and Tenure

Under the Corporate Governance Guidelines, ("Guidelines"), whicha non-management director shall not be nominated for election to the Board after attaining the age of 72, unless nominated by the Board for special circumstances. The Board does not believe it is appropriate or necessary to limit the number of terms a director may serve. The Board values the participation and insight of directors who have developed an increased understanding of the Company and the specific issues it faces doing business in a complex, regulated industry, as well as those directors who bring fresh and varied perspectives, resulting in a Board with a balanced tenure.

| WEC Energy Group | P-14 | 2023 Proxy Statement |

Time Commitment

Our Corporate Governance Committee recommends and the Board nominates candidates whom they believe are availablecapable of devoting the time necessary to carefully fulfill their fiduciary duties. The Corporate Governance Committee regularly reviews stockholders’ views on the appropriate number of public company boards on which directors may serve, which the Board takes into consideration each year as it reviews its Corporate Governance sectionGuidelines.

The Corporate Governance Guidelines limit the maximum number of the Company’s website at www.wecenergygroup.com/govern/governance.htm. Thesepublic company boards on which a WEC Energy Group director may serve to four public companies (including our Board), and specify that any public company chief executive officer who serves as a director on our Board may not serve on more than two public company boards (including our Board). Limited exceptions may be made with Corporate Governance Committee approval. All of our director nominees are in compliance.

Independence

Our Corporate Governance Guidelines providestate that to be independent, the Board should consist of at least a two-thirds majority of independent directors. The independence standards found in our Guidelines are not only in compliance with the listing standards of the New York Stock Exchange (“NYSE”), but are actually more stringent than the NYSE rules. In order to be deemed independent, the individual must have no material relationship with the Company that would interfere with the exercise of good judgment in carrying out his or her responsibilities as a director.

The independence standards found in our Corporate Governance Guidelines are not only in compliance with the listing standards of the New York Stock Exchange (“NYSE”), but are actually more stringent than the NYSE rules. Our director independence guidelines are located in Appendix A of our Corporate Governance Guidelines, which are available on the Corporate Governance section of the Company’s website at www.wecenergygroup.com/govern/governance.htm.

Prior to initial and annual election, all directors complete a detailed questionnaire that elicits information that is used to ensure compliance with the Board’s and the NYSE’s standards of independence. The Corporate Governance Committee also reviews potential conflicts of interest, including related-party transactions, interlocking directorships, and substantial business, civic and/or social relationships with other members of the Board that could impair the prospective Board member’s ability to act independently from the other Board members and management. The Board also considers whether a director’s immediate family members meet the independence criteria outlined in the Corporate Governance Guidelines, as well as whether a director has certain relationships with WEC Energy Group’s affiliates, when determining the director’s independence.

The Board has affirmatively determined that Directors Bowles, Budney, Chadwick,Bie, Culver, Cunningham, Farrow, Fischer,Garcia-Thomas, Green, Knueppel, Lane, Payne, Stanek, and StanekTellock are independent. Directors Klappa and FletcherLauber are not independent due to their employment with the Company. Allen Leverett resigned fromJ. Kevin Fletcher, the Board in July 2019; heCompany’s Chief Executive Officer and President until February 1, 2022, who was alsoa director until that date, was not independent due to his employment with the Company.

Director Stanek.Stanek

Since 2005, WEC Energy Group has engaged Baird Financial Group (“Baird”) primarily to provide consulting services for investments held in the Company’s various benefit plan trusts. Baird also provides certain related administrative services. The Board reviewed the terms of this engagement, including the approximately $729,800$754,451 in fees paid to Baird in 20192022 (which are less than one-tenth of 1% of Baird’s total revenue), and Ms.Director Stanek’s position at Baird, and concluded that such engagement is not material and did not impact Ms.Director Stanek’s independence. Ms.Director Stanek is not involved with and does not consult on the contract with or recommendations made by Baird and receives no direct financial benefit from these services. WEC Energy Group management evaluates Baird’s services against market standards for overall quality and value on a regular basis. Neither the Board nor Ms.Director Stanek plays a role in the retention of Baird for these services or any related negotiation of commercial terms. In addition, WEC Energy Group’s pension trusts and other benefit accounts do not hold any investments in Baird funds.

| WEC Energy Group | P-15 | 2023 Proxy Statement |

SUCCESSION PLANNING AND DIRECTOR NOMINATION PROCESS

Board Succession Planning

Our Board is regularly engaged in rigorous discussions about the Board’s plans for ongoing succession, taking into consideration matters such as: current inventory of director skills and qualifications; diversity, including gender, race/ethnicity, retirement age and tenure; and future competencies needed to support appropriate oversight of the Company’s long-term strategy and related risks and opportunities. These discussions are co-facilitated by the Executive Chairman and Independent Lead Director during the Board’s executive sessions.

During 2022, these discussions took into consideration the Board’s desire to add further utility industry experience, including a deep understanding of risks and opportunities facing utilities, such as those related to climate change, while being mindful of the Board’s goal to return to over 30% female representation.

Guided by the Board’s succession planning discussions, the Corporate Governance Committee, comprised entirely of independent directors, is responsible for identifying and recommending director candidates to our Board for nomination.

Director Nomination Process

The Corporate Governance Committee is responsible for recommending a slate of nominees to the Board for election at each Annual Meeting of Stockholders using the formal process detailed below.

| 1 | Board Succession Planning | 2 | Identify Candidates | 3 | Evaluate Candidate Recommendations | 4 | Meet with Candidates | 5 | Recommend Candidate Nomination | ||||

| Develop list of skills and qualifications sought in new directors and evaluate current Board composition | Proposed by stockholders, directors, and/or others | Screen qualifications, assess impact on Board composition, and review independence | Multiple meetings scheduled with the Board Executive Chairman and Independent Lead Director, other members of Corporate Governance Committee, and other members of the Board | Corporate Governance Committee considers feedback and makes recommendation to the Board | |||||||||

| 1. | Board succession planning.The Corporate Governance Committee facilitates the director recruitment and nomination process through the lens of the Board’s ongoing director succession planning process, as described above. The Corporate Governance Committee seeks to fulfill its duty to stockholders to consistently maintain a Board that is comprised of directors who each embody key attributes, and who, as a group, have the skills and experiences to effectively oversee management’s strategy for operating in a complex industry while performing their fiduciary obligations. | |

| 2. | Identify candidates. Candidates for director nomination may be proposed in a number of ways, including by stockholders, the Corporate Governance Committee, and other members of the Board. The Corporate Governance Committee may retain a third party to identify qualified candidates. No such firm was engaged with respect to the nominees listed in this proxy statement. | |

| The Corporate Governance Committee will consider director candidates recommended by stockholders provided that the stockholders comply with the requirements and procedures set forth in our bylaws. Stockholders may also nominate or recommend director candidates by following the procedures outlined on P-77. No formal stockholder nominations or recommendations for director candidates were received in connection with the 2022 Annual Meeting of Stockholders. | ||

| Director Bie was elected to the Board effective January 1, 2023. Director Bie was initially recommended for consideration by the Executive Chairman, following which the Corporate Governance Committee undertook the evaluation process described immediately below. | ||

| 3. | Evaluate candidate recommendations. The Committee follows an established process for evaluating all director candidates whether recommended by directors, stockholders or others. During this process, the Corporate Governance Committee reviews publicly available information regarding each identified candidate to assess whether that person should be considered further. The Corporate Governance Committee considers whether each individual embodies the key attributes listed above, as well as the person’s qualifications, experience, skills, outside affiliations, age, gender, race and ethnicity. The Committee will utilize third parties if and as needed to assist with these activities. | |

| As part of the evaluation process, the Corporate Governance Committee takes steps to ensure that the pool of director nominees contains the attributes, skills and experiences identified during Board succession planning discussions. If the Corporate Governance Committee determines that a candidate warrants further consideration, the Executive Chairman or another member of the Board of Directors contacts the prospective director. | ||

| Generally, if a recommended candidate expresses a willingness to be considered and to serve on the Board, the Corporate Governance Committee will seek the Board’s concurrence in moving the candidate forward to the interview stage of the nomination process. Further, it will instruct management to solicit from the candidate information used to review the candidate’s independence as well as assess any potential conflicts of interest or reputational risk. |

| WEC Energy Group |

| 4. | Meet with candidates. Candidates initially meet with the Executive Chairman, Independent Lead Director and other members of the Corporate Governance Committee. Upon agreement that a candidate has the attributes, skills and other identified factors the Board is seeking for its desired composition, all Board members are provided an opportunity to meet with the candidate and provide feedback to the Corporate Governance Committee. | |

| 5. | Recommend candidate nomination.The Corporate Governance Committee will review feedback received from the meetings with the candidates and engage in constructive dialogue, following which it will make a recommendation regarding nomination for the Board’s discussion and final determination. |

| RESULTS è | Board Refreshment 2019-2023 added 5 independent directors |

| These new independent directors added since 2019 have brought the following skills, experiences and/or traits to our Board: | |

| —— ADDITIONS —— | ||||||||

Oct. 2019 Maria C. Green |

Jan. 2020 Thomas K. Lane |

Jan. 2021 Cristina A. Garcia-Thomas |

Jan. 2022 Glen E. Tellock |

Jan. 2023 Ave M. Bie | ||||

All have advanced levels of competency in • Senior Leadership • Strategic Planning • Corporate Governance | Areas and/or attributes of particular focus during recruitment included: ✓ Gender and racial/ethnic diversity ✓ Technology and cyber security knowledge ✓ Experience with sustainability matters, including risks and opportunities of climate change ✓ Human capital management ✓ Audit / financial / risk oversight expertise ✓ Regulated and utility industry background |

Included in each director nominee’s biography that follows are career highlights and other public directorships, along with the key qualifications, skills and expertise that we believe each director contributes to the Board. Our Board considered all of these factors, as well as the results of our annual Board evaluation, when deciding to re-nominate these directors.

| WEC Energy Group | P-17 | 2023 Proxy Statement |

2023 DIRECTOR NOMINEES FOR ELECTION

The following 12 individuals have been nominated for election to the Board of Directors at the WEC Energy Group2023 Annual Meeting.

| Ave M. Bie | Independent |

| |

| Age: 65 Director Since: January 1, 2023 Board |

Professional Experience

Quarles (formerly known as Quarles & Brady LLP) – Retired Partner, 2005 to June 2015.

Other Public Directorships

None

Director Qualifications

A retired business law, utilities and energy attorney who spent her legal career counseling utilities and independent power producers, Director Bie brings to our Board of Directors extensive investment management expertiseindustry experience across all aspects of the utility industry, from government relations and permitting to counseling on infrastructure and long-range planning. At the time of her retirement in 2022, she was a partner at the law firm Quarles, where, for over 20 years she focused on developing regulatory strategies to address critical infrastructure and renewable portfolio standards. While at Quarles, she developed the firm’s corporate and social responsibility initiatives, leading the firm’s efforts for five years. Prior to joining Quarles, Director Bie served for seven years as the Chair of the Public Service Commission of Wisconsin, addressing both transmission and generation infrastructure issues, including the review and approval of utility projects. The Board also greatly benefits from the insights Director Bie has gained from more than 35 yearsas the past Chair and current Vice Chair of experience as an investment professional, portfolio manager or principal. As founderthe board of the New York Independent System Operator, which operates the New York state bulk electricity grid and President of Ravengate Partners, a firm that has been educating and advising businesses and not-for-profit institutions about the financialadministers competitive wholesale markets, and global macro economy since 1999, Ms. Chadwick's insights into the investment industry’s perspectives is valuable to the Board’s financialconducts comprehensive long-term planning and strategy discussions. Her knowledgeadvances the technological and security infrastructure of capital markets is particularly helpful to WEC Energy Group and its subsidiaries, which operate in a capital intensive industry and consistently access the capital markets. Ms. Chadwick serves as a director and committee member on the boards of two registered investment companies, Voya Mutual Funds and The Royce Funds, through which she has developed extensive governance experience with respect to audit oversight and financial reporting.electric system serving New York. As a board director and Finance Committee member of Amica Mutual Insurance Company, she has gained a deep understanding of insurance risk management and oversight matters, which is valuable experience that she applies to her role on the WEC Energy Group Finance Committee andour Audit and Oversight Committee.

| Curt S. Culver | Independent |

| Age: Director Since: Board Committees: |

Professional Experience

MGIC Investment Corporation - Non-Executive Chairman of the Board since March 2015. Served as Chairman from 2005 to February 2015, CEO from 2000 to February 2015, and President from 1999 to 2006. MGIC Investment Corporation is the parent of Mortgage Guaranty Insurance Corporation.

Other Public Directorships

Director of MGIC Investment Corporation since 1999.

Director of WEC Energy Group since 2004; Director of Wisconsin Electric Power Company (subsidiary of WEC) from 2004 to June 2015.

Having served for 15 years as the CEO of Mortgage Guaranty Insurance Corporation and its parent company, MGIC Investment Corporation, Mr.Director Culver brings to our Board of Directors a strong working knowledge of the strategic, economicoperational, financial, and public policy issues facing a large, regulated, publicly-held company headquartered in Milwaukee Wisconsin. His expertise in risk management and oversight is particularly valuable in his service as chair of the Finance Committee, while his insurance industry experience puts him in a position to lead the Committee’s evaluation of the Company'sCompany’s overall financial risk management program. Mr. Culver'sDirector Culver’s broad corporate governance experience, developed from his extensive past and present service on the MGIC boards, as well as those of several highly-visible Milwaukee-area non-profit entities and two private for-profit organizations, is of great value to the Board as it carries out its oversight responsibilities.responsibilities, including the duties of the Corporate Governance Committee, of which he is a member.

| WEC Energy Group | P-18 | 2023 Proxy Statement |

| Danny L. Cunningham | Independent |

| Age: Director Since: Board |

Professional Experience

Deloitte & Touche LLP - Retired Partner and Chief Risk Officer. Served as Partner, from 2002 to 2015, and as Chief Risk Officer, from 2012 to 2015.January 2016. Deloitte & Touche LLP is an industry-leading audit, consulting, tax, and advisory firm.

Other Public Directorships

Director of Enerpac Tool Group Corp. (formerly known as Actuant Corporation) since 2016.

Director of WEC Energy Group since January 2018.

Director Cunningham brings to our Board of Directors more than 30 years of experience serving public audit clients in a broad array of industries, including manufacturing printing, process, software and financial services, as well as a deep understanding of the business, economic, compliance, and governmentalregulatory environment in which the Company and many of the Company'sits major customers operate. Mr. Cunningham’sDirector Cunningham applies his strong expertise in financial reporting, accounting, internal controls, and audit functions are ofto his responsibilities as WEC Energy Group’s Audit and Oversight Committee Chair. This experience also contributes great value to the Board as it fulfills its responsibility for oversight of the Company'sCompany’s accurate preparation of financial statements and disclosures, and compliance with legal and regulatory requirements. Having served as chief risk officer at Deloitte & Touche, LLP, heDirector Cunningham gained keen insights into the complexities of risk management, through which heand applies histhis expertise in assessing the effectiveness of the Company'sCompany’s practices and policies to mitigate enterprise-wide risks. Mr.Director Cunningham’s multi-national experience brings the added diversity of a global perspective to the Board as it evaluates its strategic objectives, while his past service on the boards of several major Milwaukee-area not-for-profit organizations equips him to contribute thoughtful insights on issues impacting the city’s culture, workforce and economic vitality.

| William M. Farrow III | Independent Lead Director |

| Age: Director Since: Board Committees: |

Professional Experience

Winston and Wolfe, LLC - Chairman and Chief Executive Officer since 2010. Winston and Wolfe LLC is a privately held technology development and advisory company.

Urban Partnership Bank - Served asRetired President and CEO, from August 2010 until retirement in Januaryto 2018. UPB provides financial services in moderate income communities located in Chicago, Detroit and Cleveland.

Other Public Directorships

Director of CBOE Global Markets Inc. since 2016; 2016.

Director of Echo Global Logistics Inc. since 2017.

Director ofQualifications

In serving as WEC Energy Group since January 2018.

| WEC Energy Group | P-19 | 2023 Proxy Statement |

| Cristina A. Garcia-Thomas | Independent |

| |

| Age: 53 Director Since: 2021 Board |

Professional Experience

Advocate Health (formerly Advocate Aurora Health) - PrincipalSenior Vice President and Chief Diversity, Equity and Inclusion Officer since 2002. Fischer Financial Consulting LLC provides consulting on corporate financial, accounting,December 2022; Chief External Affairs Officer, April 2018 to December 2022; Chief Experience Officer, October 2017 to April 2018; Chief Diversity Officer and governance matters.

Advocate National Center for Health Equity, president since December 2022. Advocate National Center for Health Equity is a nonprofit center innovating strategies for equitable health and health care for all.

Other Public Directorships

None

Director of Enerpac Tool Group Corp. (formerly known as Actuant Corporation) from 2003Qualifications

Director Garcia-Thomas brings to January 2017; Director of Badger Meter, Inc. since 2003; Director of Regal Beloit Corporation since 2004.

| |

| Maria C. Green | Independent |

| Age: Director Since: Board |

Professional Experience

Ingersoll Rand Inc.plc - Retired Senior Vice President and General Counsel, having served in those roles from 2015 to June 2019. Ingersoll Rand Inc. is a diversified industrial manufacturer with market-leading brands serving customers in global commercial, industrial and residential markets.

Other Public Directorships

Director of Tennant CompanyCo. since May 2019; 2019.

Director of Littelfuse Inc. since February 2020.

Director of WEC Energy GroupFathom Digital Manufacturing Corporation since October 2019.

Director Qualifications

Director Green brings to our Board of Directors senior leadership experience accumulated during her 35-year career in law and business, including extensive public company experience in strategic planning, acquisitions, enterprise risk management and shareholder relations. Sherelations, from which she provides valuable insights in her service as a member to both our Finance and Audit and Oversight Committees. Director Green has substantial experience with respect to corporate sustainability matters, including oversight responsibility for environmental compliance and corporate responsibility reporting, as well as engagement with investors on these matters. Having served in the role of corporate secretary for several public companies, Ms.Director Green’s deep corporate governance experience is of tremendous value to theour Board as it carries out its evolving oversight responsibilities. Ms.Director Green also contributes valuable insights into the economic, educational and social matters impacting the greater Chicago community, where the Company has two utility subsidiaries. In particular, these insights come from having served for 18 years at Illinois Tool Works, a Fortune 200 global diversified manufacturing company headquartered in the northern suburbs of Chicago, and as a member (and past chairman) of the Chicago Urban League executive committee.

| WEC Energy Group | P-20 | 2023 Proxy Statement |

| Gale E. Klappa | Executive Chairman |

| Age: Director Since: Board Committee: |

Professional Experience

WEC Energy Group, Inc. - Executive Chairman since February 2019; Chairman of the Board and CEO, from 2004 to May 2016 and October 2017 to February 2019; Non-Executive Chairman of the Board, from May 2016 to October 2017; President, from 2003 to August 2013.

Wisconsin Electric Power Company (subsidiary of WEC)WEC Energy Group) - Chairman of the Board, from 2004 to May 2016 and January 2018 to February 2019; CEO, from 2003 to May 2016 and January 2018 to February 2019; President, from 2003 to June 2015.

Director of Wisconsin Electric Power Company, (subsidiary of WEC Energy Group) from 2003 to May 2016 and January 2018 to present.

Chairman Klappa also serves as a director of several other major subsidiaries of WEC Energy Group.

Other Public Directorships

Director of Associated Banc-Corp since 2016.

Director of Badger Meter, Inc. since 2010. (Planned Retirement: April 2023)

Director Qualifications

Chairman Klappa has more than 4045 years of experience working in the public utility industry, including more than 2530 at a senior executive level. He first retired as the Company'sCompany’s CEO in May 2016, at which time he assumed the role of Non-Executive Chairman of the Board. Chairman Klappa again served as the Company’s CEO between October 2017 and February 2019. Prior to joining the Company in 2003, Mr.Chairman Klappa served in various executive leadership roles at The Southern Company, a public utility holding company primarily servingheadquartered in the southeastern United States. Under his leadership, WEC Energy Group successfully completed its 2015 acquisition of Integrys Energy Group, which nearly doubled the employee and customer population, and increased the Company’s geographic footprint to four states. With his extensive experience in the business operations and C-suite leadership of publicly regulated utilities, his service as a board member for several other public companies, and his contributions to significant economic development initiatives in southeastern Wisconsin, Mr.Chairman Klappa has led theour Board with a deep understanding of the financial, operational, and investment decisions and public policy issues facing large public companies. In October 2017, after the Company’s then-CEO suffered a stroke, the Board appointed Mr. Klappa to serve in the role of CEO, while also having him retain his role of Board Chairman. With the appointment of Mr. Fletcher as CEO effective February 2019, Mr. Klappa now serves as Executive Chairman. Mr. Klappa’sHis deep knowledge of the Company’s industry, customers, stockholders, and management team is of great value to theour Board.

| Thomas K. Lane | ||

| |

| Age: 66 Director Since: 2020 Board Committees: Audit and Oversight; |

| |

Professional Experience

Energy Capital Partners LLC - Vice Chairman since 2016;2017; Partner, from 2005 to 2016.2017. Energy Capital Partners is a private equity firm that focuses on investing in power generation, midstream gas, electric transmission and energy and environmental services sectors of North America'sAmerica’s energy infrastructure.

Other Public Directorships

Director of Summit Midstream Partners, LP, since 2009; 2009 to May 2020.

Director of USD Partners, LP, since 2014.

Director of WEC Energy Group since January 2020.

Director Lane brings to our Board of Directors more than 30 years of broad financial experience focused within the energy sector. His experience in this area includes 17 years in the Investment Banking Division at Goldman Sachs where Mr. Lane held senior-level coverage responsibility for electric and gas utilities, independent power companies and midstream energy companies throughout the United States,sector, which provides him with a deep understanding of the complexities inherent to delivering strong financial performance in a regulated industry. ForHis experience in this area includes 17 years in the past 15 years, Mr.Investment Banking Division at Goldman Sachs where he held senior-level coverage responsibility for electric and gas utilities, independent power companies and midstream energy companies throughout the United States. Director Lane has significant experience in assessing the individual components of the Company’s financial performance and how it relates to the Company’s compensation program, experience he gained over the course of his career, which has been focused within the energy sector, and which is very valuable to his service as a member of our Compensation Committee. Since 2017, Director Lane has served as a senior executiveVice Chairman of Energy Capital Partners, wherefollowing 12 years as a partner of the firm. During this tenure, he has held responsibility for establishing and executing the firm’s investment strategies, which include projects encompassing power generation and renewables, as well as midstream and environmental infrastructure. This experience enables him to add significant value to the Board’s oversight of the Company’s long-term growth strategy, as does his substantial experience planning and executing merger and acquisition strategies. Having testified before the House Energy Subcommittee on energy relatedenergy-related matters, Mr.Director Lane also brings to theour Board an understanding of the formulation of energy policy at the Federalfederal government level. AsHis strong financial reporting experience within a regulated industry, combined with his broad understanding of the risks facing the utility sector, provide tremendous value in his service as a member of the WEC Energy Group Finance Committee, Mr. Lane’s expertise in financial management strategy serves as valuable input to the Company’s execution of its financial plan.

| WEC Energy Group | P-21 | 2023 Proxy Statement |

| Scott J. Lauber | President and CEO |

| Age: 57 Director Since: 2022 Board Committee: None |

Professional Experience

WEC Energy Group - President and CEO since February 1, 2022; Senior Executive Vice President and Chief Operating Officer from June 2020 to January 31, 2022; Senior Executive Vice President and CFO from October 2019 to June 2020; Senior Executive Vice President, CFO and Treasurer from February 2019 to October 2019; Executive Vice President, CFO and Treasurer from October 2018 to February 2019; Executive Vice President and CFO from April 2016 to October 2018.

Wisconsin Electric Power Company (wholly owned subsidiary of WEC Energy Group) - Chairman of the Board and CEO since February 1, 2022; President since January 1, 2022; Executive Vice President from June 2020 to December 31, 2021; Executive Vice President and CFO from April 2016 to October 2018 and from October 2019 to June 2020; Executive Vice President, CFO and Treasurer from October 2018 to October 2019.

Director of Wisconsin Electric Power Company since April 2016.

Director Lauber also serves as an executive officer and/or director of several other major subsidiaries of WEC Energy Group.

Other Public Directorships

None

Director Qualifications

Director Lauber has more than 30 years of experience working at WEC Energy Group and/or its subsidiaries and has held senior leadership levels for the past 11 years. A certified public accountant, Director Lauber first joined the Company in 1990 and held positions of increasing responsibility in the areas of financial planning and management, accounting, and internal controls. In April 2016, he was named Executive Vice President and Chief Financial Officer for WEC Energy Group, and added the Treasurer responsibilities in October 2018. From there, he advanced through multiple executive leadership positions, including as Executive Vice President and Chief Operating Officer, a position that included oversight responsibility for Information Technology, Enterprise Risk Management, Major Projects, Power Generation, Supply Chain, Supplier Diversity, and WEC Infrastructure and Fuels. Effective February 2022, Director Lauber was named President and Chief Executive Officer of WEC Energy Group and appointed to the Board of Directors. As President and Chief Executive Officer of WEC Energy Group’s major utilities in Wisconsin, Michigan and Minnesota, Director Lauber is directly responsible for business operations in those jurisdictions. With his deep expertise in financial and investment matters, in addition to his extensive knowledge and experience in the broad scope of the Company’s business operations critical to its continuing success as a leading Midwest public utility holding company, Director Lauber contributes substantive insight into the Company’s strategies, objectives, risks and opportunities.

| Ulice Payne, Jr. | Independent |

| Age: Director Since: Board Committees: |

Professional Experience

Addison-Clifton, LLC - Managing Member since 2004. Addison-Clifton, LLC provides global trade compliance advisory services.

Other Public Directorships

Director of Foot Locker, Inc. since December 2016; 2016.

Director of Manpower Group since 2007; 2007.

Trustee of The Northwestern Mutual Life Insurance Company, from 2005 to 2018.

Director of WEC Energy Group since 2003; Qualifications

Director of Wisconsin Electric Power Company (subsidiary of WEC Energy Group) from 2003 to June 2015.

| WEC Energy Group | P-22 | 2023 Proxy Statement |

| Mary Ellen Stanek | Independent |

| Age: 66 Director Since:2012 Board Committee: Finance |

Professional Experience

Baird Financial Group - Managing Director and Director of Asset Management since 2000. Baird Financial Group provides wealth management, capital markets, private equity, and asset management services to clients worldwide.

Baird Advisors - Co-Chief Investment Officer since 2022; Chief Investment Officer since 2000.2000 to 2022. Baird Advisors is an institutional fixed income investment advisor.

Baird Funds, Inc. - President since 2000. Baird Funds is a publicly registered investment company.

Other Public Directorships

Trustee of The Northwestern Mutual Life Insurance Company since 2009.

Director of Journal Media Group, Inc. and its predecessor companies from 2002 to April 2016.

Director of WEC Energy Group since 2012; Director of Wisconsin Electric Power Company (subsidiary of WEC Energy Group) from 2012 to June 2015.

| Glen E. Tellock | Independent |

| Age: 61 Director Since: 2022 Board Committee: Audit and Oversight |

Professional Experience

Lakeside Foods Inc. - Retired President and proxy advisors.

The Manitowoc Company, Inc.- Chairman of the Board, which align with the recommendations containedFebruary 2009 to October 2015; President and Chief Executive Officer, May 2007 to October 2015. The Manitowoc Company designs, manufactures, markets, and supports construction and commercial food service equipment.

Other Public Directorships

Director of Astec Industries, Inc. since 2006.

Director of Badger Meter, Inc. since 2017.

Director Qualifications

Director Tellock brings to our Board of Directors extensive executive leadership experience, having retired in the Commonsense Principals 2.02021 as president and CEO of Corporate Governance,Lakeside Foods, a governance framework that was first publishedprivately held, international food processor headquartered in 2016 byWisconsin. This follows a group24-year career at The Manitowoc Company, a manufacturer of businessconstruction and investment leaders, include:

| WEC Energy Group | P-23 | 2023 Proxy Statement |

Governance

PRIMARY ROLE AND RESPONSIBILITIES OF OUR BOARD

Our Board is responsible for Company culture, including among other things: non-retaliation for raising concerns; safety; diversity and inclusion; conflictsproviding oversight with respect to matters of interest; confidentiality; fair dealing; protection and proper use of Company resources, assets and information; and compliance with laws, rules and regulations (including insider trading laws). For more information, see the Governance section ofconcern to our website: www.wecenergygroup.com/govern/codeofbusinessconduct.pdf

Leadership Succession Planning

Company leaders are responsible for developing the talent across the organization through the broadening and deepening of business and leadership knowledge. Succession planning and internal talent development are strategic priorities of the Company and integral components of our approach to human capital management, which includes engagement at all levels of the organization, and with the Board.

The Compensation Committee has primary oversight for executive succession planning and development, and periodically reviews and assesses the Company’s strategies and initiatives relating to human capital management. The Committee regularly reports to and engages with the Board about these matters.

2022 Highlights

Throughout 2022, the Board was actively engaged in oversight of the senior and executive management succession planning process. The Board spent considerable time, particularly during its executive sessions, discussing management’s plans to foster a deep talent bench and plan for senior leadership succession, including development plans to prepare senior leaders for greater responsibilities. The effectiveness of this oversight was particularly apparent in 2022 as partthe Board achieved a seamless transition to a new Chief Executive Officer and a new President of its evaluationIllinois utility subsidiaries, and ended 2022 with the most diverse senior leadership team in Company history.

Oversight of Strategy

The Board believes that a fundamental, collective understanding of the Company's ongoing operations and strategic direction. Toissues facing the Company is imperative to its ability to carry out its strategic oversight function,responsibilities. Throughout the year, the Board is organized into five standing committeesengages in substantive discussions with specific dutiesmanagement about the Company’s strategy. Elements of strategy are discussed within the Board committee meetings and risk-monitoring responsibilities: Auditat every regularly scheduled Board meeting. This includes updates from management on the Company’s financial performance and Oversight, Compensation, Corporate Governance, Executivethe status of operational and Finance. Withsocial goals and performance, and the exceptioninternal and external factors that influence performance and sustainability.

At least annually, the Board engages in significant educational sessions that include briefings and presentations from the Company’s senior leadership team, other members of the Executive Committee, each of the Board’s committees meets regularly throughout the year, and receives regular briefings prepared by management, and outside advisors and subject matter experts, including scientists and institutional investors. These sessions help the Board to understand the environment within which the Company operates and the risks and opportunities presented thereby, and inform and shape the Board’s understanding of management’s decision-making, leading to more effective oversight of the Company’s short-, medium- and long-term strategies and operational objectives.

2022 Highlights

The Company closed out 2022 having achieved record net income and record earnings per share, while also returning more cash to stockholders than in any other year in Company history. Significant progress was made on specific areasthe Company’s continuing energy transition including regulatory approval for its first two solar-battery projects. The Board executed on its succession plan and appointed a new female director effective January 1, 2023, who brings significant knowledge and experience surrounding major risks and opportunities facing the utility sector, including those related to climate change, advancing technology and cyber security.

Oversight of currentRisk Management

Our Board of Directors is responsible for providing oversight with respect to our major strategic initiatives, which requires ongoing dialogue with our senior management team about opportunities and emerging risks, and the processes through which senior management maintains focus on the organization’s key financial and business objectives, corporate policies, and overall economic, environmental and social performance. Senior management, in turn, is responsible for effectively planning and executing daily operations within a strong risk framework.

With that in mind, the Company has created a framework from which management is able to provide meaningful information to the enterprise, as captured throughBoard to aid in its oversight responsibility. Included below is a high-level overview of that structure.

Audit Services

As a standing corporate practice, each year, management systematically evaluates the Company's enterpriseCompany’s risk management framework.

| WEC Energy Group | P-24 | 2023 Proxy Statement |

Enterprise Risk Steering Committee

Chaired by the Chief Executive Officer and consisting of other senior-level management employees, our Enterprise Risk Steering Committee (“ERSC”) regularly reviews the Company’s key risk areas and provides input into the development and implementation of effective compliance and risk management practices. On a regularbimonthly basis, the ERSC discusses findings of thisAudit Services’ annual enterprise risk assessment, holds in-depth discussions with members of management on identified subjects, and tracks progress andthe status of mitigation efforts. Senior management is taskedongoing progress. The Chief Executive Officer provides the Board with ensuring that theseroutine updates on the Company’s key risk areas during the Board meetings, including summaries from the bimonthly discussions held by the ERSC.

Climate Risk: Given the significant risks and opportunities are appropriately addressed.associated with climate change, management has created a separate committee under the guidance of the Chief Executive Officer. The resultsClimate Risk Committee, which is a sub-committee of these risk management efforts are reportedthe ERSC, brings together senior-level officers responsible for overall climate-related corporate strategy. This committee meets at least quarterly to review and discuss climate-related goals, risks and opportunities.

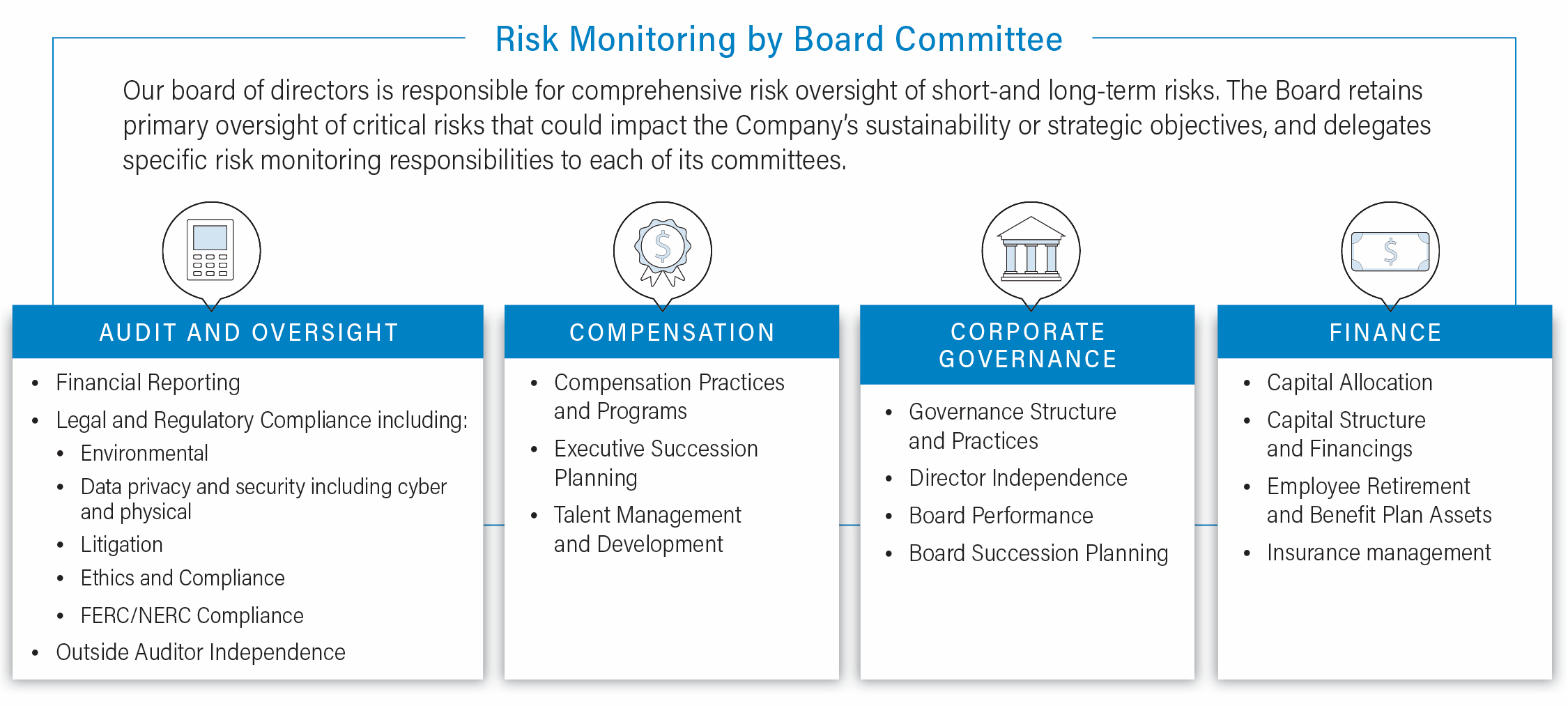

Board Committees

To carry out its oversight function, the executive leadership teamBoard is organized into five standing committees with specific duties and arerisk-monitoring responsibilities: Audit and Oversight, Compensation, Corporate Governance, Executive and Finance. With the subjectexception of regular reports tothe Executive Committee, the Board and each of its committees.

The committeesCommittees routinely report to the full Board on matters that fall within the designated areas of responsibility as described in their respective charters. Examples of risk monitoring activity that have been designated to the full Board and its committees are shown in the chart below. More information on the committees'committees’ duties and responsibilities begins on page P-25.P-32.

Board of Directors

While the Board delegates specified duties to its committees, the Board retains collective responsibility for comprehensive risk oversight, including short- and long-term critical risks that could significantly impact the Company's sustainability.Company. The Board believes that certain risksmatters should be contemplated by the diverse perspective of its full Board. Examples include the Board's (i)membership. This includes oversight of environmental, social and socialgovernance risks includingthat have the potential to result in significant financial or reputational consequences that could impact the Company’s brand, limit its sustainability or jeopardize its value to stockholders.

As part of climate change on the utility sector, (ii) reviewBoard’s approach to risk oversight and approvalmanagement, the Chief Executive Officer provides reports to the Board at each Board meeting and routinely calls upon members of mergers and acquisitions, and (iii) review and approvalthe management team to provide detailed reports to the Board in their respective areas of significant capital projects and investments.responsibility, including matters of enterprise risk.

Executive Sessions

Executive sessions for the non-management directors are generally held at every regularly scheduled boardBoard and committee meeting, during which directors have direct access to, and meet as neededdesired with, Company representatives to discuss matters of interest, including those related to risk management.

Outside of scheduled meetings, the Board, its committees and individual Board members have full access to executives, senior executivesmanagers and other key employees, including the CEO, CFO,Executive Chairman, Chief Executive Officer, Chief Financial Officer, General Counsel, EVP External Affairs, Chief Audit Officer, Compliance Officer, Chief Information Officer and Controller. They are also free to engage as needed with the leaders of our utility companies and our corporate center departments, including customer service, environmental, external affairs,enterprise security, human resources, investor relations, tax and treasury.

| WEC Energy Group | P-25 | 2023 Proxy Statement |

Risk Oversight Responsibilities

The Board believes that its leadership structure, in combination with management'smanagement’s enterprise risk management program, effectively supports the Board’s risk oversight function of the Board.function.

| Board Oversight | ||||||

• Short- and long-term strategy and strategic initiatives • Risk management processes • Leadership succession planning • Code of Business Conduct | • Mergers and acquisitions • Sustainability matters, including climate and emissions reduction strategies • Regular reporting from Board committees on specific risk oversight responsibilities | |||||

| Committees | ||||||

| Audit and Oversight | Compensation | Corporate Governance | Finance | |||

• External Auditor Independence • Ethics and Compliance Program • Financial Reporting • Legal and Regulatory Risks and Compliance, including: • Data privacy and security, including cyber, physical and operating technology • Electric reliability standards • Environmental • Government relations, including political spending and lobbying • Litigation | • Compensation Practices and Programs • CEO Performance • Executive Succession Planning • Human Capital Management and Development | • Board Performance • Board Succession Planning • Director Independence • Governance Structure and Practices | • Capital Allocation • Capital Structure and Financings • Employee Retirement and Benefit Plan Assets • Insurance Management | |||

| Management Responsibilities | ||||||

• Design and operate enterprise risk management program, including risk identification, assessment and prioritization • Conduct regular, executive-level committee review of key risk areas with updates to Board • Engage with Board and committee chairs on areas of assigned risk oversight | ||||||

| WEC Energy Group | P-26 | 2023 Proxy Statement |

OUR ENVIRONMENTAL, SOCIAL AND SOCIAL GOVERNANCE COMMITMENT

The Board is vigilant in its oversight of management’s strategic decision-making as it navigates important developments in the utility industry. This includesBoard’s oversight of the Company’s strategic direction includes reviewing with senior management our approach we take in fulfillingto environmental, social and social stewardshipgovernance matters. The Board is mindful of itsmanagement’s responsibility to provide safe, reliable and affordable energy, to preserve the Company’s long-term value and to make choicesdecisions that take into account not only the Company’s stockholders, but also the interests of its other stakeholders, including our stakeholdersemployees and the well-being of ourthe communities we serve, now and in the future.

Below are some highlights from 2022 that demonstrate the Company demonstrated itsCompany’s and the Board’s commitment to ensuring that the Company’s goals and practices are aligned with a strong focus on environmental, social and social stewardshipgovernance priorities and, ultimately, sustainability. More details on Company performance in 2019key areas are spotlighted below.available under “2022 WEC Energy Group Operational Goals and Performance under the Short-Term Performance Plan,” which begins on P-49.

Delivering a clean energy future:future

ESG Progress Plan: A Road Map for Investment in Efficiency, Sustainability and exceeded our 2030 goalGrowth